It's been a while, but the current financial crisis in Barnet deserves some context as this mess has been 15 years in the making. I have been following Barnet's finances since 2010 and I have made regular comments on the financial strategy.

One thing I have commented on repeatedly is council tax freezes. Some may say it was a great thing as it kept council tax costs down for residents but in reality it is just kicking the problem down the road. The council tax element was frozen between 2010/11 and 2018/19 - they did include a social care precept between 2016/17 and 2018/19 but the council tax element remained frozen and in 2014, just before the election, they actually cut council tax by 1%

Well, in 2025 we have reached the end of that road and it looks like a disaster of epic proportions. Often council tax freeze are driven by political decisions not rational logical decisions. A great example of this was in 2012 when the plan was to increase council tax by 2.5% but the plan was scrapped and a demand by senior politicians for savings to be made instead - you can see the blog a a video of the meeting here.

I have always said that freezing council tax for one year has long term implications as you are, in effect, reducing the council tax base by that amount every year going forward because each future year's calculation starts from that lower base.

I blogged about it again in 2013, 2014, 2017 and again in 2018 making the same point that this was storing up massive problems for the future.

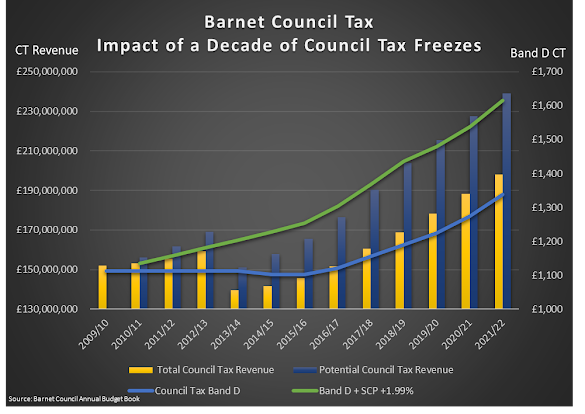

I decided to go back and update all the figure with a more detailed analysis of the impact of the freezes. Set out below is a graph which shows the impact of these freezes.

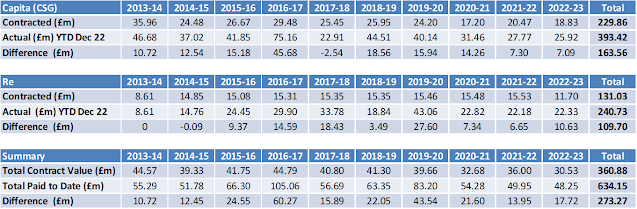

Getting into more detail I have set out in the table below, the basis of the figures. I tried to be as accurate as possible using not just the revenue figures but also the number of properties in paying council tax - the council provide the number of Band D equivalent properties as part of their calculations in the Council's Annual Budget Book/ Financial Forward Plan and Capital Programme

What the figures show is that if Barnet had taken modest rises of 1.99% every year instead of freezing or cutting council tax, by 2022 there would have been £41m a year more revenue coming from Council Tax. National government must also bear some of the blame as for a number of years the government subsidised council tax freezes for that specific year. But the problem is that a subsidy is only for one year but the freeze represents a recurring loss.

Labour are not entirely blameless as the year after they came in they reversed the 1% increase in council tax made the previous year by the Tories. The big problem is councils are around for the long term but politician come and go and the decision they make are often very short term and politically motivated. The residents of Barnet now face the consequences of those actions.

It is also interesting to not that the cumulative lost revenues over the period 2010/11 to 2021/22 is £273million which maybe could have been spent on improving the infrastructure and services in Barnet. The old saying, "you get what you pay for" is truism but it has consequences and we are seeing them realised now.